Home > Project Closing > Indirects/Bond > Bond Calculation

Bond Calculation

|

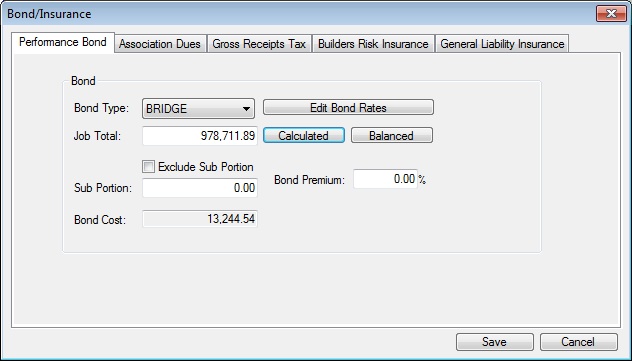

If you select the Bond Cost item from the Indirects Sheet, you will see the screen shown in figure 3.70. The steps involved in entering a bond are:

|

| (1) |

Select the Bond Type |

| (2) |

Enter the Bid Total (Calculated or Balanced) on which to calculate the bond

|

| (3) |

Enter a bond premium rate(if any) |

| (4) |

Enter the Gross Receipts Tax (GRT) rate |

| (5) |

Enter the Bid Total (Calculated or Balanced) on which to calculate the GRT

|

| (6) |

Select SAVE

|

|

|

Figure 1

|

|

Bond Type

|

If the applicable bond rate type is not listed in this list box, select “Edit Bond Rates” to add a new bond rate table. |

|

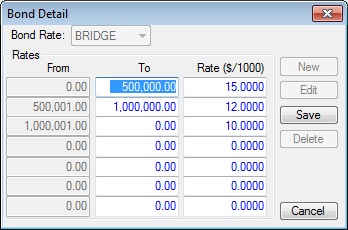

Edit Bond Rates

|

This button allows you to edit or add a bond rate table. A sample bond rate table is shown in Figure 3.71

|

|

Figure 2

|

|

Exclude Sub Portion

Button

|

Checking this option will exclude the sub cost for those sub items loaded from a pricing sheet that already includes the bond cost. |

|

Bond Premium %

|

This field allows you to enter a bond premium (as a percentage) to be added to the calculated bond cost. |

|

Gross Reciepts Tax Tab

|

This field is used to enter the percentage to be used to calculate the Gross Receipts Tax (GRT) based upon the total bid. This option is only applicable in states that have a GRT.

|

|

Associatin Dues Tab

|

This field is used to enter the percentage to be used to calculate the association dues. This option is only applicable is you are a member of an association that charges dues as a percentage of your contract amount.

|

|

Job Total

|

You can directly enter the project total or use the "Calculated" or "Balanced" buttons explained below.

|

|

|

This button will automatically enter the Calculated bid total into the Job Total field. The total will include all costs calculated above (bond premium, gross reciepts tax, and association dues). |

|

|

This button will automatically enter the Balanced bid total into the Job Total field. This total will include all costs calculated above (bond, GRT and association dues). |

|

Press the SAVE button to save the values you entered on this screen. When you return to the indirects worksheets, you will notice a new item will be added to the worksheet. The system will automatically add an item for BOND COST and/or GROSS RECIPTS TAX and/or Association Dues. You cannot edit these values directly, but if you double click the item on the Indirects Worksheet, this same screen will be displayed allowing you to change any of the values.

|

|

See also